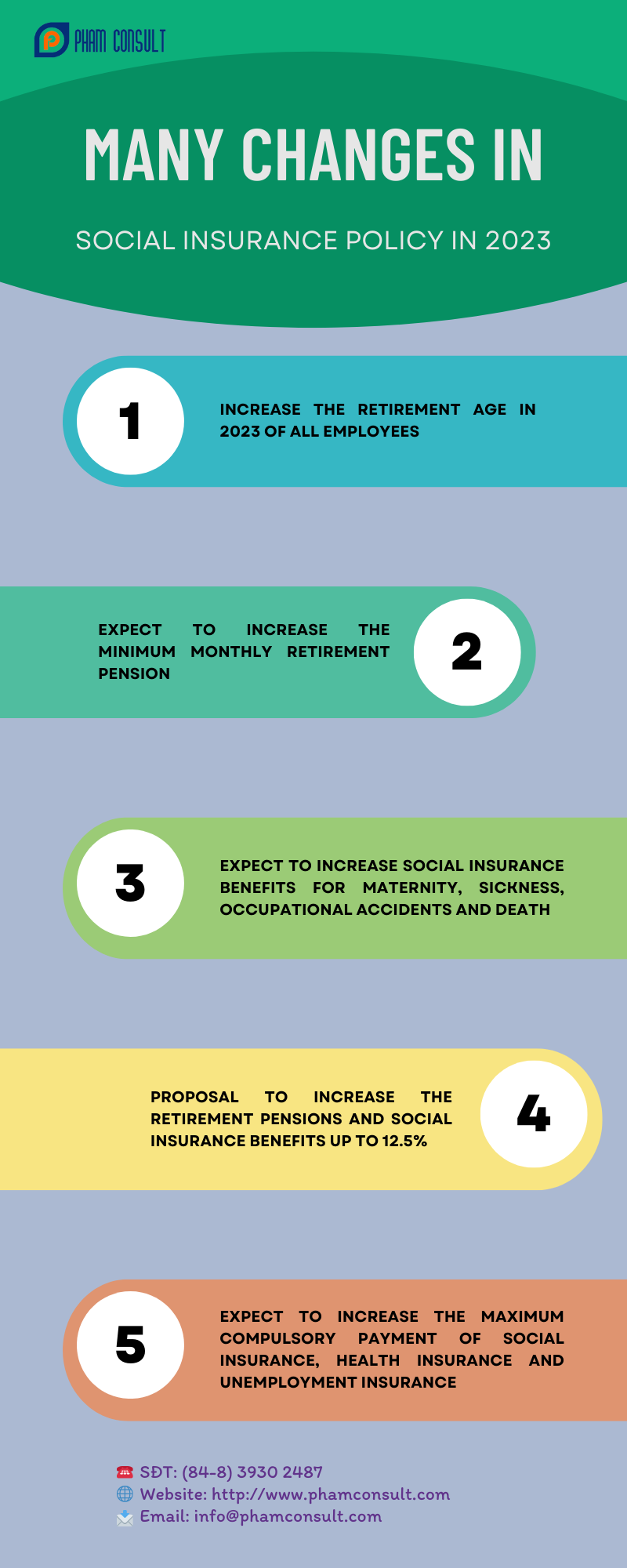

In 2023, the social insurance policy will have many changes as it is affected by the adjustment of regulations on working age and base salary.

1. Increase the retirement age in 2023 of all employees

In 2023, the retirement age of employees working in normal conditions is determined as follows:

● Male employees: From full 60 years old 09 months.

● Female employees: From full 56 years old.

In addition, if there are additional factors such as reduced working capacity; having full 15 years of working coal mining in underground mines; having full 15 years of working in arduous, hazardous jobs, etc., the employee may retire from 5 to 10 years earlier than the above-mentioned age.

Accordingly, it can be seen that compared with the current provisions of the Labor Code 2019, the retirement age of male workers in normal conditions has increased by 09 months and female employees has increased by 08 months.

“Clause 2, Article 169 of the Labor Code 2019:

2. Retirement ages of employees in normal working conditions shall be gradually increased to 62 for males by 2028 and 60 for females by 2035.

From 2021, the retirement ages of employees in normal working conditions shall be 60 years 03 months for males and 55 years 04 months for females, and shall increase by 03 months for males and 04 months for females after every year”

2. Expect to increas the minimum monthly retirement pension

In 2022, the Government submitted to the National Assembly a proposal to increase the base salary from VND 1,490,000/month to VND 1,800,000/month, expected to be implemented from July 1, 2023. At the National Assembly session, many deputies proposed to increase wages from January 1, 2023, instead of July 1 as proposed to contribute to reducing difficulties and ensuring people’s lives.

If the proposal is approved, the minimum pension rate of employees participating in social insurance who retires in 2023 will also be increased due to the provisions of the Law on Social Insurance 2014, the low pension rate. When participating in compulsory social insurance, it is equal to the base salary.

Therefore, if the base salary increases, the lowest pension that employees receive when they retire will also reach VND 1,800,000/month.

3. Expect to increase social insurance benefits for maternity, sickness, occupational accidents and death

The preparation to increase the base salary has a great influence on the social insurance policy in 2023. Accordingly, if in 2023, the base salary increases, the following allowances will also increase:

3.1. Increase the level of allowance for convalescence and recovery after illness

According to clause 3, Article 29 of the Law on Social Insurance 2014, the rate of convalescence and health rehabilitation after illness is calculated as follows:

Sickness allowance/day = 30% x Base salary

Accordingly, if the base salary is increased to VND 1,800,000/month, the allowance for convalescence and health rehabilitation after illness will increase to VND 540,000/day.

3.2. Increase the one-time allowance when giving birth or adopting a child

According to Article 38 of the Law on Social Insurance 2014, female employees who give birth or adopt children under 6 months old will be entitled to a one-time allowance at the following rate:

One-time allowance for childbirth or adoption/child = 2 x Base salary

In the case of giving birth to a mother and child but only the father participates in social insurance or the mother participates in social insurance but is not eligible, the father will be paid this allowance.

Accordingly, if the basic salary increases, the employee’s one-time allowance when giving birth or adopting a child will also increase to VND 3,600,000/child.

3.3. Increase the level of health care, and restore health after pregnancy

According to clause 3, Article 41 of the Law on Social Insurance 2014, the allowance for convalescence and health rehabilitation benefits for female employees after maternity is calculated as follows:

Sickness allowance/day = 30% x Base salary

Accordingly, if the base salary increases, the level of enjoyment of the convalescence and health rehabilitation regime after maternity in 2023 will also increase to VND 540,000/day.

3.4. Increase the level of one-time allowance when suffering a labor accident or occupational disease

According to Article 48 of the Law on Occupational Safety and Health 2015, employees suffering from occupational accidents or diseases leading to a decrease in working capacity from 5% to 30% will receive a one-time allowance.

This allowance is included in the allowance calculated according to the degree of working capacity decrease and the allowance calculated according to the number of years of paying social insurance premiums. Which, the level of allowance calculated according to the level of labor reduction is determined as follows:

Allowance = 5 x Base salary + (% of labor reduction – 5) x 0.5 x Base salary

Thus, if the base salary is increased as proposed, the one-time allowance calculated according to the degree of decrease in labor when suffering an occupational accident or occupational disease will increase to VND 9,000,000 if there is a 5% decrease in working capacity labor; then for every 1% decrease, you will get an additional VND 900,000.

3.5. Increase the monthly allowance when suffering a labor accident or occupational disease

According to Article 49 of the Law on Occupational Safety and Health 2015, employees suffering from occupational accidents or diseases leading to a decrease in working capacity of 31% or more will receive a monthly allowance.

This allowance is included in the allowance calculated according to the degree of working capacity decrease and the allowance calculated according to the number of years of paying social insurance premiums. Which, the level of allowance calculated according to the level of labor reduction is determined as follows:

Allowance/month = 30% x Base salary + (% of labor reduction – 31) x 2% x Base salary

Thus, if the base salary is increased as proposed, the monthly allowance calculated according to the degree of decrease in labor in case of occupational accidents or occupational diseases will increase to VND 540,000/month if there is a 31% decrease in working capacity labor; then, for every 1% decrease, you will be entitled to an additional VND 36,000/month.

3.6. Increase the level of allowance for people suffering from work accidents and occupational diseases

According to Article 52 of the Law on Occupational Safety and Hygiene 2015, an employee with a working capacity reduction of 81% or more suffers from spinal paralysis or blindness in both eyes or amputation, paralysis of two limbs, or mental illness. The gods are entitled to a monthly service allowance equal to the base salary.

Thus, if the base salary is increased, the service allowance will also increase to VND 1,800,000/month.

3.7. Increase the one-time allowance when dying due to a work accident or occupational disease

According to Article 53 of the Law on Occupational Safety and Health 2015, an employee who dies due to an occupational accident or occupational disease, his/her relatives will be entitled to a one-time allowance as follows:

1 time allowance = 36 x Base salary

If the base salary increases, this allowance will increase to VND 64,800,000.

3.8. Increase the level of convalescence, and restore health after treatment of injury and illness

According to Article 54 of the Law on Occupational Safety and Health 2015, an employee returns to work after stabilizing his injury due to an occupational accident or illness due to an occupational disease. On the first day, if their health has not yet recovered, they are entitled to take rest and recover their health for 5 to 10 days.

The rate of convalescence after treatment/day = 30% x Base salary

Accordingly, if the base salary increases, the level of enjoyment of the convalescence and health rehabilitation regime after treatment of injuries and illnesses in 2023 will increase to VND 540,000/day.

3.9. Funeral allowance increase

According to the provisions of Article 66 of the Law on Social Insurance 2014, employees are participating in social insurance, reserving the payment process, enjoying pensions, are receiving allowances for labor accidents and occupational diseases daily. If an employee dies from a work accident or occupational disease every month, his/her family member will receive a funeral allowance as follows:

Funeral allowance = 10 x Base salary

Thus, if the base salary increases, the funeral allowance will increase to VND 18,000,000.

3.10. Increase the monthly death benefit

According to Article 68 of the Law on Social Insurance 2014, the monthly survivorship allowance is as follows:

● Relatives without direct caretaker:

Monthly survivorship allowance = 70% x Base salary

● Remaining case:

Monthly survivorship allowance = 50% x Base salary

If the base salary increases, the monthly survivorship allowance will increase to VND 1,260,000/month for unaccompanied relatives, and the remaining will increase to VND 900,000/month.

4. Proposal to increase the retirement pensions and social insurance benefits up to 12.5%

In addition to the proposal to increase the base salary, the Government also proposes to increase pensions and social insurance allowances for those whose state budget pays about 12.5%, and at the same time provide additional support for those on leave. low-wage pensioners before 1995 in 2023.

This increase is calculated by the Government based on the basic salary increase as well as the actual situation, to ensure income for those who have retired in previous periods, thereby narrowing the gap in pensions.

Therefore, by 2023, previously retired employees will have the opportunity to increase their pension benefits up to 12.5%.

5. Expect to increase the maximum compulsory payment of social insurance, health insurance and unemployment insurance

According to Decision 595/QD-BHXH, the salary used as the basis for payment of compulsory social insurance, health insurance, and unemployment insurance is the monthly salary on which social insurance premiums are based.

In there:

5.1. Compulsory payment of social insurance

According to Decision 595/QD-BHXH, every month employees must pay compulsory social insurance at the rate of 8%.

On the other hand, the maximum monthly salary used as the basis for payment of compulsory social insurance = 20 x Base salary.

Therefore, if the base salary increases, the maximum compulsory social insurance premium will increase to VND 2,880,000/month.

5.2. Compulsory payment of health insurance

According to Decision 595/QD-BHXH, every month employees must pay health insurance at the rate of 1.5%.

On the other hand, the maximum monthly salary used as the basis for health insurance premium payment = 20 x Base salary.

Therefore, if the base salary increases, the maximum health insurance premium will increase from VND 447,000/month to VND 540,000/month.

5.3. Compulsory payment of unemployment insurance

According to Decision 595/QD-BHXH, every month, employees must pay unemployment insurance at the rate of 1%.

Meanwhile, the maximum monthly salary used as the basis for paying unemployment insurance premiums for employees working under the state-paid salary regime is only 20 times the base salary.

Therefore, if the base salary increases, the maximum unemployment insurance premium of these workers will increase to VND 360,000/month.

6. Legal basis

● Labor Code 2019;

● Law on Social Insurance 2014;

● Law on Occupational Safety and Hygiene 2015;

● Decision 595/QD-BHXH issued on April 14, 2017.

Above is an article that provides legal knowledge about new points in the social insurance policy in 2023. Pham Consult is a unit specializing in providing tax consulting services, financial consulting, accounting services, salary preparation, and payment. Customers can contact us via hotline: (84-28) 3930 2487 or our Facebook if need support.

VI

VI