According to the Law on Value-Added Tax 2008, revised in 2016, value-added tax (VAT) for construction activities in other provinces are different from that at headquarters, also known as external temporary VAT, is a tax payable to tax authorities when constructing and installing real estate in other provinces.

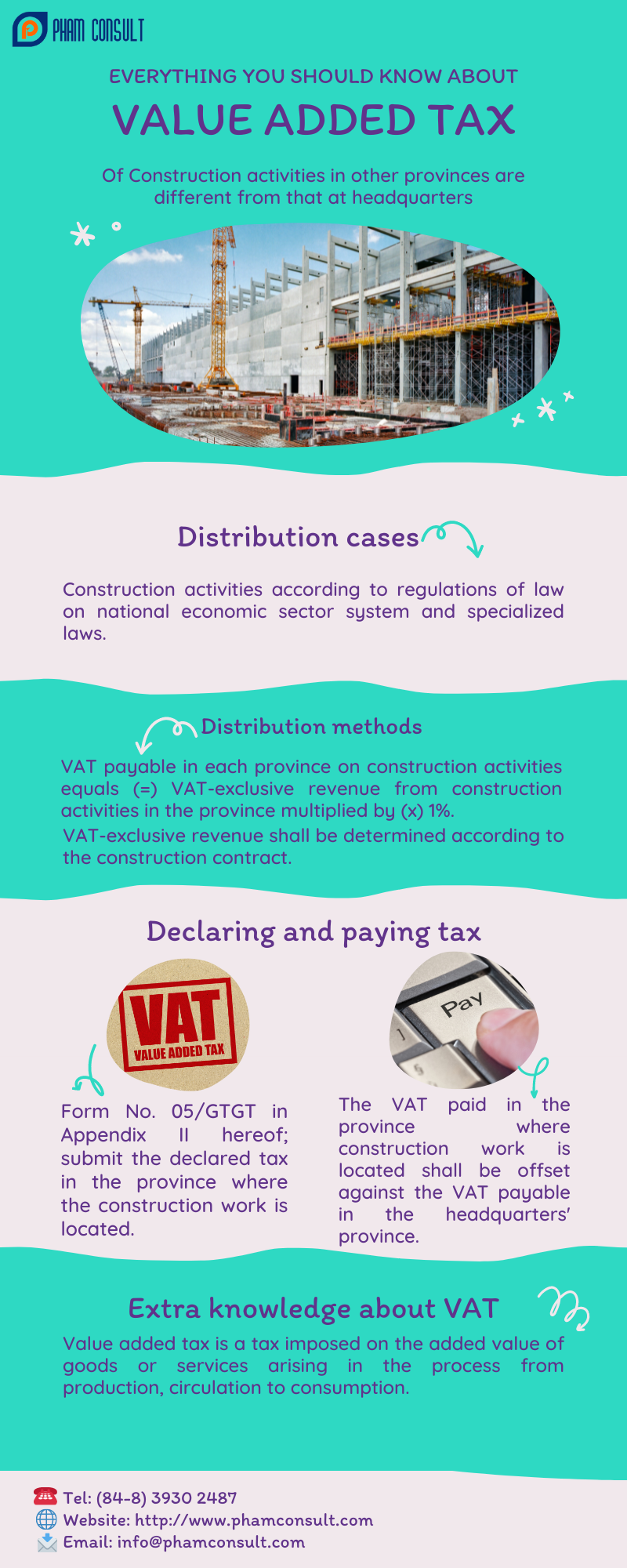

1. In case of having to declare current VAT outside the province for construction activities

According to point dd, clause 1, Article 11 of Circular 156/2013/TT-BTC (amended in Circular 26/2015/TT-BTC), extraprovincial construction and installation with the value of VND 1 billion or higher inclusive of VAT, the current VAT must be declared in that locality.

“dd) Where the taxpayer engages in an extraprovincial construction, installation, or sale with the value of VND 1 billion or higher inclusive of VAT, or extraprovincial real estate transfer (except for the case in Point c Clause 1 of this Article) without establishing an affiliate in that province (hereinafter referred to as extra-provincial business), the taxpayer must submit a tax declaration to the tax authority of the locality where the extraprovincial business takes place.

Directors of local Departments of Taxation shall decide the place where tax on extraprovincial business is declared”.

According to point c, clause 1, Article 13 of Circular 80/2021/TT-BTC, the cases in which VAT is allocated:

“c) Construction activities according to regulations of law on the national economic sector system and specialized laws”.

2. Method of allocation of external current VAT for construction activities

According to point c, clause 2, Article 13 of Circular 80/2021/TT-BTC, the external current VAT for construction activities is distributed as follows:

“VAT payable in each province on construction activities equals = VAT-exclusive revenue from construction activities in the province multiplied by x 1%.”

In there:

+ Revenue excluding VAT is determined according to the contract for construction works and work items;

+ In case the construction works or work items are related to many provinces but it is not possible to determine the revenue generated by each work in each province, the taxpayer shall determine the rate of 1% on the turnover of the work. work items; then, continue to base on the ratio (%) of the investment value of the work in each province to the total investment value to determine the amount of VAT payable to each province.

This is a new difference in the regulations on tax obligations when the investor only has to allocate 1% to the local budget where the construction works compared to 2% before (as prescribed in Circular 26/2015/TT-BTC).

3. Tax declaration, tax payment

3.1. Where there is a construction site

Taxpayers must declare and pay tax in the locality where the construction works:

- Declare VAT of works, work items in the province different from where the head office is located with the tax agency where the construction works, using form No. 05/GTGT ;

- Pay the declared tax to the state budget in the province where the construction work is located;

- If the State Treasury has made deductions (details at 4), the taxpayers are not required to pay the tax amounts already withheld by the State Treasuries.

3.2. Where the head office is located

Taxpayers must sum up the VAT-exclusive revenue from construction activities in the tax declaration dossiers at the head office to determine the payable tax amount for all production and business activities at the head office.

Note: The VAT paid in the province where the construction works are offset against the tax payable at the head office.

4. Regarding the deduction of VAT by contractors when carrying out the procedures for payment of capital construction investment capital of the state budget to the investor

- The State Treasury where the investor opens a transaction account shall deduct VAT to pay into the state budget. The amount of tax withheld is determined as follows: “VAT deducted = Sales without VAT for the completed volume of works, basic construction work items x 1%”.

- When making payments at the State Treasury, the investor must make a payment voucher according to the prescribed form and send it to the State Treasury for VAT deduction. The tax with held by the State Treasury on payment vouchers shall be deducted from the payable tax amount of the contractor. The investor needs to provide payment documents that have been withheld by the State Treasury to the contractors.

- The accounting of state budget revenues for the VAT already deducted by the State Treasury according to the principle that in which province the capital construction works arise, the value-added tax withheld by the State Treasury will be recorded in the budget revenue of that province.

- In case the work is located in more than one province, the investor shall determine the tax-exclusive revenue for each province, make a payment voucher according to the prescribed form and send it to the State Treasury for a tax deduction and accounting. budget for each province. If the work or item is located in more than one province, it is not possible to determine the revenue of the work in each province, the determination of VAT payable for each province shall be done according to the proportion distribution as above.

* Cases in which VAT is not deductible

- The investor shall carry out procedures for advance capital construction investment according to regulations

- Payments for capital construction investment capital for project management activities: (i) Payments for project management works directly performed by investors; (ii) Expenditures of the project management board, expenses for site clearance, expenditures for self-made projects

- Construction investment expenses of projects and works under the commune budget with a total investment of less than VND 1 billion

- Cases where taxpayers prove that they have fully paid taxes into the state budget.

5. Legal basis

- Law on Value Added Tax 2008, revised in 2016

- Circular 156/2013/TT-BTC

- Circular 26/2015/TT-BTC

- Circular 80/2021/TT-BTC

The above is an article providing legal knowledge about the regulations of external temporary VAT for construction activities. Pham Consult is a unit specializing in providing tax consulting services, financial consulting, accounting services, salary preparation, and payment. Customers can contact us via hotline: (84-28) 3930 2487 or our Facebook if you have any questions or need support.

VI

VI