In the era of integration, there are many foreigners currently living and working in Vietnam. This makes the finalization of personal income tax complicated and makes many people confused because they do not know how to do it properly. The following article Pham Consult will provide information and guide the process of personal income tax finalization for foreigners in Vietnam.

Subjects of personal income tax finalization for foreigners in Vietnam

Subjects of personal income tax finalization include persons authorized to make finalization or foreigners making the finalization themselves.

Foreigners authorized to make personal income tax finalization

Foreigners earning income from wages or salaries authorize businesses or individuals to pay income for personal income tax finalization in the following cases:

- That individual only has income from salary, and wages, and signs a labor contract of 03 months or more at an enterprise. By the time of authorizing finalization, that individual must be working in reality;

- That individual has income from wages and salaries as above, and at the same time has additional current income from other sources (house rental, land lease, etc.).

Note: Income-paying businesses/individuals will only make a finalization for foreigners with the portion that he/she receives from such income-payers.

Foreigners directly make personal income tax finalization

- Foreigners who have incomes from business activities, wages, salaries, or have multiple sources of income subject to personal income tax, additional tax payable, overpaid tax, request for a refund, or offset against the next tax return period;

- Foreigners with income from two or more places;

- Foreigners earning income from business activities;

- Foreigners who transfer securities are required to finalize personal income tax.

Some special cases

- Foreigners residing in Vietnam have incomes from business, salaries, and wages. If such a person is present in Vietnam for less than 183 days in the first calendar year, but if counting in 12 consecutive months from the first day of his/her presence in Vietnam is 183 days or more, there will be a time limit to submit separate tax finalization dossiers;

- Foreigners who terminate working contracts in Vietnam, make tax finalization declarations with tax authorities before exiting Vietnam;

- Foreigners have a claim for overpaid tax refund or offset in the following tax payment period.

Guidance on personal income tax finalization for foreigners

The calculation of personal income tax for a foreigner depends on whether he is a resident individual or not. Therefore, it is necessary to identify this problem to be able to conduct tax calculations correctly.

Resident individual

For resident individuals, part of their taxable income is generated inside and outside the territory of Vietnam, regardless of where the income is paid. Formula:

Payable personal income tax = Taxable income x Tax rate

In there:

Taxable income = Taxable income – Deductions

Taxable income = Total income – Tax-exempt items

If a foreigner signs a labor contract for 3 months or more in Vietnam, it will be calculated according to the partial progressive schedule, under 3 months, it will be calculated according to the full schedule x 10% tax rate

The full progressive tax schedule for foreigners earning income from wages and salaries is as follows:

|

Tax bracket |

Taxable income (TI)/month | Tax

(%) |

Tax calculation |

|

1 |

<5 million VND | 5% |

5% x TI |

|

2 |

5-10 million VND | 10% |

10% x TI – 0.25 million VND |

|

3 |

10-18 million VND | 15% |

15% x TI – 0.75 million VND |

|

4 |

18-32 million VND | 20% |

20% x TI – 1.65 million VND |

|

5 |

32-52 million VND | 25% |

25% x TI – 3.25 million VND |

| 6 | 52-80 million VND | 30% |

30% x TI – 5.85 million VND |

| 7 | Over 80 million VND | 35% |

35% x TI – 9.85 million VND |

For non-resident individuals:

Taxable income is income generated in Vietnam, regardless of where the income is paid. Formula:

Personal income tax payable = Taxable income x Tax rate of 20%.

Personal income tax finalization documents for foreigners

For each case, the foreigner will have a different declaration and declaration method.

Documents for tax finalization

- Foreigners receiving income from foreign countries or international organizations: They need to prove the payment confirmation, and letter of confirmation made according to form No. 20/TXN-TNCN, issued together with Circular No. 156/2013/ TT-BTC.

- Foreigners subject to tax arising outside the territory of Vietnam: Need to submit additional documents required in the personal income tax finalization dossier

- If the tax authority in a foreign country does not issue a certificate of tax payment, the individual will have to take a photo of the certificate of tax deduction or replace it with a photocopy of the bank statement showing the tax amount. paid abroad. In addition, must undertake to be responsible for the accuracy and truthfulness of such snapshots.

Where to submit personal income tax finalization documents for foreigners

Step 1: Prepare personal income tax finalization documents for foreigners

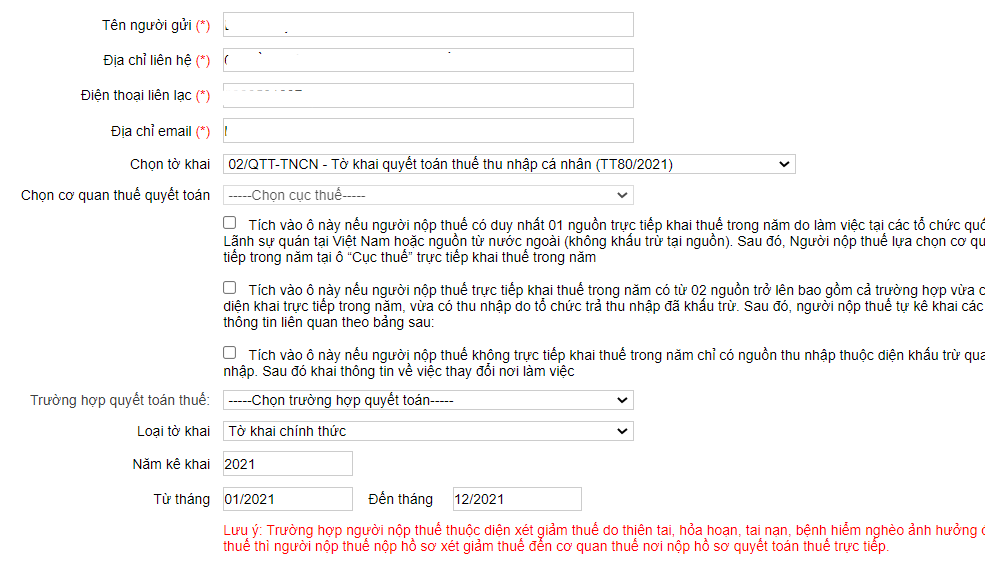

Access the website of the General Department of Taxation, and log in by entering your tax code and the checked code.

Step 2: Submit personal income tax finalization documents for foreigners

Select the “Tax finalization” item, then select “Online tax declaration” and declare the information required by the system.

After filling in the necessary information, the tax finalization declaration, select the box “I certify that the declared data and attached documents are correct and take responsibility before the law for the declared data and attached documents.” Then, check the information and click submit.

Step 3: Tax authorities handle personal income tax finalization documents

Note that when doing personal income tax finalization procedures, you must have a personal electronic tax transaction account.

A personal electronic tax transaction account is essential for online tax declaration. In addition to going to the tax office to request, taxpayers can complete the registration of an electronic tax transaction account at home through the National Public Service Portal, Vietnam e-tax portal, or the application HCM Tax.

Legal basis

- Law on Tax Administration 2019

- Law on Personal Income Tax 2007, amended and supplemented 2012

- Circular No. 156/2013/TT-BTC

- Circular No. 80/2021/TT-BTC

Pham Consult is a unit specializing in providing tax consulting services, financial consulting, accounting services, salary preparation, and payment. Contact us via hotline: (84-28) 3930 2487 or our Facebook if you need support.

VI

VI