Personal income tax is a direct tax calculated on the taxpayer’s income after deducting the income included in the exemption and deductions. However, in some cases, taxpayers will be refunded the paid personal income tax if requested and fully satisfied the prescribed conditions. In this article, Pham Consult will provide all current regulations on tax refund conditions and procedures for requesting personal income tax refunds.

WHAT IS PERSONAL INCOME TAX?

Currently, the definition of personal income tax is not provided in any legal documents. However, based on the relevant characteristics and regulations, it can be understood that personal income tax is a direct tax calculated on the taxpayer’s income after deducting the income included in the tax exemption. and deductions according to the provisions of the Law on Personal Income Tax and related documents and instructions.

Features of personal income tax:

- Firstly, personal income tax is a direct tax, whereby the state will directly collect a portion of taxpayers’ income and put it into the budget. Therefore, taxpayers cannot transfer their taxes to others.

- Second, personal income tax is always associated with social policies. The payment of taxes is to serve the state budget and contribute to social security policies as well as for public purposes.

- Finally, the taxation of personal income tax usually applies according to the principle of partially progressive tax rates, that is, the application of gradually increasing tax rates to groups of taxable objects or the entire taxable object. This means that the higher the income, the higher the tax rate.

WHAT IS A PERSONAL INCOME TAX REFUND?

Similar to the definition of personal income, based on the relevant characteristics and regulations, it can be understood that a personal income tax refund is a refund of a portion of the money paid to a taxpayer after paying income tax. individuals who fall into one of the cases are eligible for a tax refund as prescribed and have a refund request sent to the tax office.

Note: Taxpayers who fall into one of the cases eligible for a tax refund as prescribed must submit a request to the tax authority to receive a tax refund.

CASE OF PERSONAL INCOME TAX REFUND

According to Clause 2, Article 8 of the Law on Personal Income Tax 2007, the following cases are entitled to a refund of personal income tax:

2. Individuals are entitled to tax refund in the following cases:

a/ Their paid tax amounts are larger than payable tax amounts;

b/ They have paid tax but their taxed incomes do not reach a tax-liable level;

c/ Other cases decided by competent state agencies.

CONDITIONS FOR PERSONAL INCOME TAX REFUND

According to Clause 2 and 3, Article 28 of Circular 111/2013/TT-BTC, a tax refund is regulated as follows:

2. If the person that has delegated the income payer to settle tax, tax refund shall be made via the income payer. The income payer shall offset the overpaid and underpaid tax. After offsetting, the overpaid tax shall be offset against the tax in the next period or refunded on request.

3. The person that declares tax directly may choose to claim a tax refund or offset it against the tax in the next period at the same tax authority.

Thus, according to the above regulations, it can be understood that if there is no request for a personal income tax refund, the overpaid tax amount will be automatically offset in the following payment period and the tax authority will not actively refund tax.

- For individuals who have authorized tax finalization for income-paying organizations or individuals to make the final settlement, the individual’s tax refund shall be effected through the income-paying organizations or individuals.

- For individuals who directly settle with the tax authorities, can receive the overpaid tax amount back or choose to offset it with the payable tax amount of the next period.

Besides, according to the provisions of Article 28 of Circular 111/2013/TT/BTC and point b, Clause 1, Article 25 of Circular 80/2021/TT-BTC, tax refund recipients must ensure the following:

- The amount of personal income tax paid in the period is greater than the payable tax amount when finalizing.

- Already have a tax identification number at the time of requesting a tax refund.

PERSONAL INCOME TAX REFUND DOCUMENTS

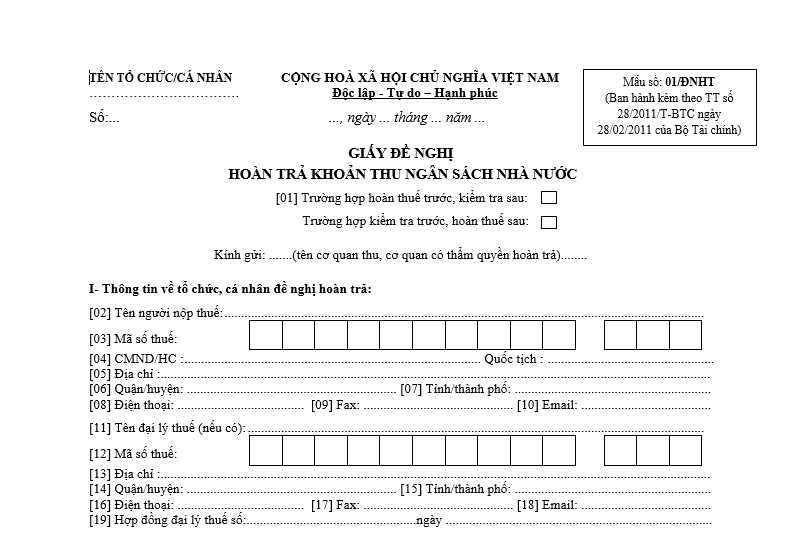

In case organizations or individuals pay incomes from salaries or wages, they shall make the final settlement for authorized individuals

- A written request for the handling of overpaid tax, late payment interest, and fines, made according to Form No. 01/DNXLNT issued together with Appendix I of Circular 80/2021/TT-BTC;

- Authorization letter as prescribed by law in case the taxpayer does not directly carry out the tax refund procedures, except where the tax agent submits the tax refund dossier under the contract signed between the tax agent and the taxpayer;

- A list of tax payment vouchers made according to form No. 02-1/HT issued together with Appendix I of Circular 80/2021/TT-BTC (applicable to income-paying organizations and individuals).

Personal income tax refund declaration form, made according to form No. 01/HT

In case individuals and individuals earn incomes from salaries or wages, they directly finalize taxes with the tax authorities

- Taxpayers with overpaid tax amounts requested for a refund on personal income tax finalization declarations (form No. 02/QTT-TNCN) are not required to submit tax refund dossiers.

- The tax authority that settles the refund shall base on the personal income tax finalization file to settle the overpaid refund to the taxpayer as prescribed.

PROCEDURES FOR REFUNDING PERSONAL INCOME TAX

- Step 1: Prepare personal income tax refund documents

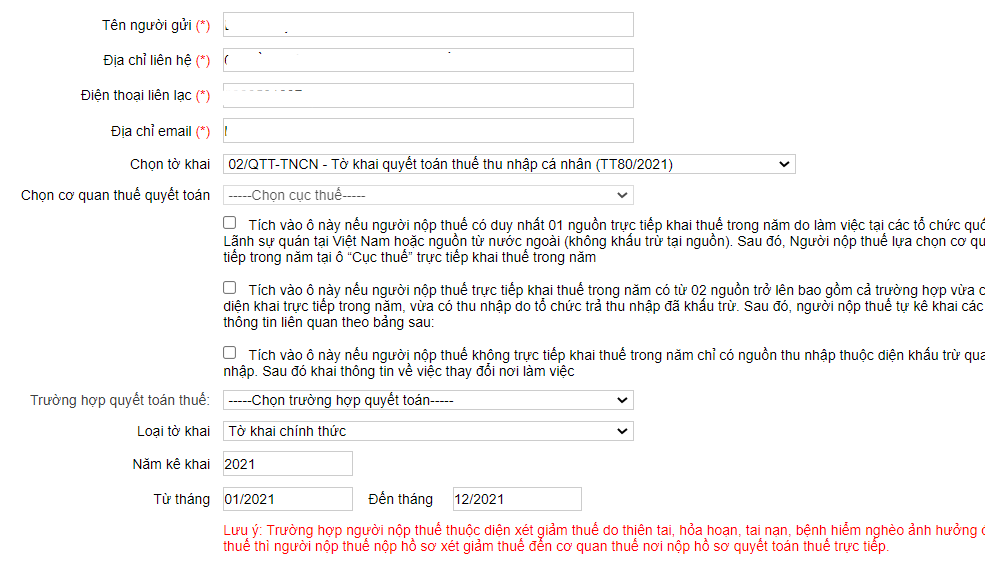

Vietnam tax website login interface

Access the website of the General Department of Taxation, login by entering the tax code and filling in the necessary information to declare online.

- Step 2: Submit personal income tax refund file

Complete the required information and then click submit

After filling in the necessary information, the tax finalization declaration, select the box “I certify that the declared data and attached documents are correct and take responsibility before law for the declared data and attached documents“. Then, check the information and click submit.

- Step 3: The tax authority processes tax refund dossiers

After receiving the online tax refund request, the tax authority will process it within 06 working days. However, depending on the type of application file, the time to settle income tax will be from 06 to 45 days.

Notes: Must have a personal electronic tax transaction account

A personal electronic tax transaction account is essential for online tax declaration. In addition to going to the tax office to request, taxpayers can complete the registration of an electronic tax transaction account at home through:

- The National Public Service Portal;

- Vietnam e-tax portal;

- The HCM Tax application.

LEGAL BASIS

- Law on tax administration 2019;

- Law on personal income tax 2007, amending and supplementing 2012;

- Circular No. 80/2021/TT-BTC

- Circular No. 92/2015/TT-BTC

- Circular No. 156/2013/TT-BTC

- Circular No. 111/2013/TT/BTC

Above is an article that provides legal knowledge about personal income tax refund cases. Pham Consult is a unit specializing in providing tax consulting services, financial consulting, accounting services, salary preparation, and payment. Contact us via hotline: (84-28) 3930 2487 or our Facebook if you need support.

VI

VI